I never thought that yoga would help me buy a house, but it did. I know you probably think of yoga as something you do in tight pants on a rubber mat, but if you pay attention, you can practice yoga anywhere. I applied the yamas and niyamas to the home-buying process. It helped me stay grounded and make the best decisions for myself.

By the way, the yamas and niyamas are part of the hatha yoga lineage passed down through the Yoga Sutras of Patanjali. They guide us through yogic ways of handling our external environment and our internal landscape. If you want more background, see the following resources at Ekhart Yoga and Yoga Journal.

I hope that by reading to the end you’ll see that buying a house is possible with the right steps. I can’t say what your experience will be like, but it wasn’t nearly as hard as I thought it would be. It took me six 👏 whole 👏 years 👏 to save enough money to buy a house and then I adjusted (and readjusted) my expectations. Once I was ready, the process was smooth and easy because I made a few solid decisions like picking an incredible agent and phenomenal lender. Shoutout to Chris Griffin and John Larabell. (Little did I know, the real adventure began after closing! Lol.)

The following words are a timeline of my experience, with each of the yamas and niyamas referenced throughout. Full disclosure; this was not an exercise in mastery for me! I screwed up a lot of things along the way. And I do mention some mistakes below, but instead, I wanted to focus on what went well. We don’t talk about that enough… the things that go right.

So anyway, here they are…

How the Yamas and Niyamas Made My Home-Buying Journey a Success

Before I started searching:

Saucha (cleanliness or purity): I started by cleaning out my old apartment and getting rid of all the clutter. This helped me stay focused on the task at hand and make space for my new home. It also lightened the load, literally, for when the time came to relocate all my treasures to a new address.

Santosha (contentment): I was content with my old apartment, even though it wasn’t perfect. I found little things to appreciate, like not having to mow a lawn, shovel snow, or rake leaves. This helped me stay positive and motivated throughout the home-buying process.

Satya (truthfulness): So many examples of this.

- Be clear about your intention for buying a home.

- Get pre-approved by a lender. That way you’ll know what your budget is.

- Pick a city. For me, the budget greatly impacted my options for what areas I could afford to live in. This was maybe the most painful part of the process because I couldn’t afford to live in my top-choice city.

Svadhyaya (self-study): I learned as much as I could about the home-buying process. This helped me make informed decisions and avoid any surprises.

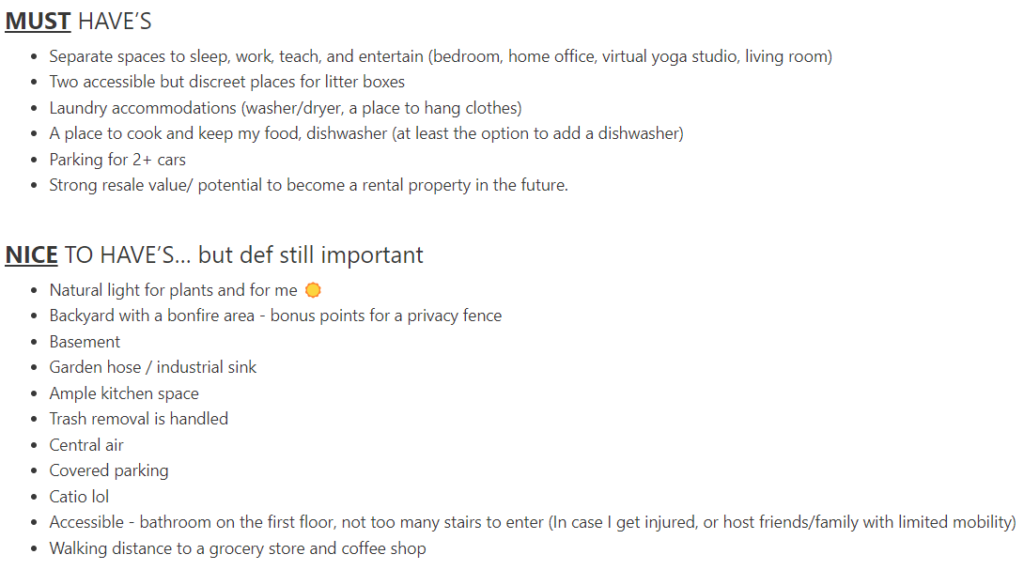

I started by making a list of all the things I need in a home by paying very close attention to my daily needs. (Svadhyaya – self-study.) Then I reverse-engineered that list to get my specs (home type, bedrooms, bathrooms, square footage, etc.). This very detailed list included things like having separate spaces to work, sleep, and teach yoga. I also distinguished between the top 5 deal-breakers and the couple dozen “nice-to-have’s”. It would’ve been nice to have a catio for my cats to hang out outdoors safely 😅, but ultimately, this house has everything I need.

Want to see my list of criteria? Here it is:

Now let’s get into the nitty-gritty of what to do before starting your search…

Find an Agent

What are the most important things you’re looking for in a real estate agent? Some qualities to consider include experience, knowledge, communication skills, responsiveness, professionalism, and trustworthiness. I wanted someone who understood how to use real estate as a tool to build wealth and invest money wisely. I also needed someone I could trust, who was responsive and professional. A big plus for those with an administrative team is that they can work more quickly and efficiently to schedule showings and complete documents on time.

I interviewed a handful of agents and asked each of them about their experience in real estate investing, what motivated them to become a real estate agent, and how they approach making offers in a competitive market. Once I found an agent I was comfortable with, I committed to working with him exclusively. You can consult with as many as you like, but once you start seeing homes, commit to one agent. It’s a tough biz, so be respectful of their time and resources.

If you’re in Southeast Michigan, I can’t say enough good things about Chris Griffin at Griffin and Partners. Chris is not your average real estate agent; he’s the kind of person who excels at building genuine connections with clients, finding those hidden gem deals, and working his magic to secure wins – even in this fiercely competitive market. Sure, anyone can get a property under contract, but not everyone has Chris’s knack for navigating all the nitty-gritty details of the process.

So, when you’re on the hunt for a real estate partner who’s not only skilled but also a joy to work with, Chris is your go-to. And if you ever need advice on choosing the right teammate for your real estate journey, don’t hesitate to drop me an email. I’m here to help!

Find a Lender

I recommend looking for someone with these traits:

- Responsiveness. You need someone who can send a preapproval letter on short notice during evenings and weekends when you’ll most likely be looking. Especially in today’s seller’s market, you need someone who will allow you to act fast when you find the right property.

- Technical expertise. Does this person know what loan product is a fit for your needs? Do they know how to abide by Sallie Mae and Freddie Mac requirements if you go that route? Find someone who understands your unique situation and has a proven track record of success.

- Customer service. When you have a question, will this person tell you who to go to, or do they help pull contact info/ offer to reach out themselves?

PRO TIP 1: DO NOT RELY ONLY ON ZILLOW / REDFIN ONLINE LISTINGS. Instead of looking at houses listed, look at houses sold. This will give you a better idea of what is actually available in your price range.

PRO TIP 2: DO NOT RELY ONLY ON ONLINE CALCULATORS TO SEE WHAT YOUR HOME PURCHASE PRICE COULD BE. Banks are happy to loan you a reckless amount of money but it’s important to make sure you can afford the monthly payments.

How to Calculate Your Monthly Housing Budget

One thing that confused me was what was included in the “monthly payment”. I found that when I was speaking with my lender or agent, the monthly payment they referred to included the mortgage principal, interest, property taxes, home insurance, [and mortgage insurance (PMI) because I put down less than 20% in my downpayment.]

However! This is important, stay with me now… there’s your monthly payment, and then there’s your total monthly housing budget. So on top of what your lender and agent refer to in your “monthly payment”, your housing budget also needs to include things like utilities, maintenance, and repairs. That’s the part I struggled with at first, so let me talk you through how I did it.

I’ve heard a few rules of thumb, mentioned below. You can use these to get a rough idea of what conventional wisdom says your budget could be.

Your mortgage should be ⅔ or ¾ of your current rent to allow room for other expenses.

Your housing expenses should be no more than 30% of your gross income.

Your home purchase price should be no more than 2.5x your annual income. For example, if you make $50,000/year, your home purchase price would be up to $125,000.

I found that online tools gave me a reckless and completely irresponsible loan amount that I could qualify for. So while, yes, the bank would allow me to take out $270k, I can only take on a monthly payment from a loan of about $160k.

My monthly costs: I value transparency, though I chose to leave out specific numbers from this post. If I can help you understand how to run your numbers or point you to a professional, email me at hello@rachel.red. My monthly payment includes…

- Mortgage and interest

- Private Mortgage Insurance (because I put less than 20% down)

- Property taxes

- Homeowners insurance

I chose not to escrow to avoid the fee to open one, but a lot of people go that route. What is an escrow account, you ask? Check out this article from Bank Rate.

My Thoughts on PMI

I think it’s worth it to pay the PMI (private mortgage insurance) as I build equity because on my ~$1300 monthly payment, it’s only about $25. It’s a very worthwhile fee to get into home ownership. Definitely research it, but don’t be immediately turned off if you have to bring less than 20% to the closing table.

And now back to yoga…

During the Search:

Tapas (self-discipline): I set realistic goals for myself and was disciplined in my research. This helped me find the perfect home for me in a reasonable amount of time.

Ishvara Pranidhana (surrender to a higher power): I trusted that the universe would provide me with the perfect home at the perfect time. This helped me stay calm and relaxed throughout the process.

Ahimsa (non-violence): I was respectful of the sellers and the real estate agents involved in the home buying process. This helped me build positive relationships and make the process go more smoothly.

Satya (truthfulness): I was honest about my needs and my budget. This helped me find a home that was right for me.

Asteya (non-stealing): I refused to take up my agent’s time when I know that a house would not work for me. There was one day, he had two “meh” listings and one “oh hell no”, so I told him that I’d rather have the day to do other stuff.

Brahmacharya (moderation): I was mindful of my spending and didn’t overextend myself financially. This helped me avoid financial problems in the future.

Aparigraha (non-attachment): I didn’t get too attached to any particular home. This helped me stay objective and make the best decision for me.

Two offers got rejected. On the third house that I finally had an offer get accepted, I went to see it after a disappointing rejection the night before. It was rainy and I didn’t feel good, but I still went anyway. It’s like dating or job interviewing, you have to just keep showing up regardless of how much rejection you face.

After Closing on My House:

One night I waded deep into the columns and rows of “Spreadsheet City”, which is what I called the file I used to organize my thoughts and plans. My sincerest attempts to make order from the chaos worked only until the time came to make it work. No amount of organization or planning could have spared me the overwhelm I felt after setting foot into my house after closing. I unpacked the cleaning supplies from my car and wandered desparately from room to room, wondering “What do I do?”

This presented me yet another opportunity to practice Ishvara Pranidhana (surrender to a higher power). To surrender. To “let go and let God.”

It also is a constant lesson in Tapas (self-discipline). Do what is yours to do, and be consistent, and in time you will see the effort pay off.

Let's Talk Money.

It’s free to pick a lender and agent. You only need to pay for transportation costs, and if we’re counting non-monetary resources, it’ll cost you time as well.

You can also write offers for free, but be prepared to spend money once your house is under contract. In other words, don’t be shy about writing an offer if the property fits your list. (See my example of the criteria I needed above.) As my mom says, “Don’t tell yourself “no”, let THEM tell you “no”!”

The total cost of buying my house was $9,299, including:

- $2000 earnest money deposit (which went toward closing costs)

- $1000 inspections (home, radon, and sewer)

- $99 Freddie Mac homeowner counseling (which earned me a $1200 credit towards closing costs, so it didn’t really feel like an expense)

- $500 appraisal

- $5700 to close

I also spent about $850 on supplies from Home Depot to clean and paint the house. To those who say, “DIY-ing the paint is such a money-saver.” Well, yeah if you have the money to begin with. Sometimes a DIY approach is the only option within budget.

The house also needed a $8000 sewer line repair and $2500 in electrical work, but I expected those because of the inspections and I had the resources to cover them.

So all-in, I spent $20,649 to purchase, repair, and lightly renovate my home.

Disclosure: I had tremendous help from friends and family. Someone close to me is a professional tradesman and offered a metric sh*t ton of labor and expertise that would’ve cost me thousands if I had to hire the help. I’m so grateful for the friends who helped clean and paint this castle to its current glory.

The “I Did It All Myself” Myth

I’m suspicious when somebody claims to have bought a house “all on their own”. How often do any of us accomplish anything without support?

For me, I have a tremendous network of friends and family. My mom was a trusted advisor throughout the process. My stepdad has 45 years experience as a carpenter and networking with other tradesmen like electricians and plumbers. Before moving into the house, my team generously gifted me with 213 labor hours. That counts for a lot. So while my name is the only one on the title, I did not do this alone. And it took me years (years) to be financially comfortable enough to take the risk… because remember, it is a risk.

Yoga for Home Buyers: How the Yamas and Niyamas Can Help You Find Your Dream Home

Yamas | |

Ahimsa non-violence, non-harming, Consideration of all living things, especially those who are innocent, or worse off than we are. | Courage, dear one. Non-harming towards yourself will go a long way in the coming months. Practicing with yourself first will nurture kindness in every other area of your life. This means being polite, even if you are not happy with the way the process is going. Be open to the possibility that things might not go according to plan. Be flexible and adaptable. (To my family and friends reading this, I know I messed this one up sometimes lol. Just keepin’ it real, y’all.) Do not waive your inspection contingency. I know it’s competitive out there, but avoid putting your financial well-being at risk. Waiving contingencies can help your offer get accepted, but be careful because they could cause harm to you in the long run. You don’t have to be likable. Be a tiger. But be kind. Acknowledge the colonial and capitalist roots of the real estate industry. (Of our economy writ large, actually.) Look up the native land your house sits on through Native Land, an Indigenous-led nonprofit based in Canada. Be careful who you complain in front of. You may be going through the pains of a competitive market, but others may not have the resources to make homeownership possible. Consider the impact of your home on the environment, and choose a home that is energy-efficient and sustainable. Choose a home that has features that will help you save energy, such as solar panels or energy-efficient appliances. |

Satya truthfulness Right communication through speech, writing, gesture, and action. | First, be honest with yourself about what you can afford and what you’re looking for in a home. Carefully distinguish your needs from your wants and your short-term versus long-term goals. Get pre-approved. That way you’ll know exactly what your budget is. Pick a city. For me, the budget greatly impacted my options for what areas I could afford to live in. Tell your agent, lender, and team exactly what you need, and be clear when they suggest an idea that doesn’t work for you. Have great communication and solid boundaries with your team, family, and friends. Let your people know that you appreciate their support and give them clear expectations about how they can help. |

Asteya non-stealing Noncovetousness or the ability to resist a desire for that which does not belong to us. | Give from your overflow and not from your essence. Invest from a position of strength. That means writing offers that work for your financial situation without overextending your resources. |

Brahmacharya non-excess, moderation Moderation in all actions. | Don’t burn yourself out trying to look at houses that don’t fit your budget or criteria. It takes effort to go see homes, and I found it even more of a burden because of how far away I was and how fast the market moved. I was giving so much time and energy to looking at houses that I missed my friends. So make the effort to see homes that fit your criteria and write competitive offers. But if you find yourself seeing, like, a dozen homes, try narrowing your search or working with your agent to strategize more effective offers. Because if you continue carrying on at a high speed, you will burn out (like I almost did!) |

Aparigraha non-possessiveness, non-greed Nongreediness or the ability to accept only what is appropriate. | Get back up. Let rejections roll off your back. Get back up and keep going. Don’t get caught up in competing to have your offer accepted. Don’t let other people/ society pressure you into buying a house that you don’t really want, or discourage you from continuing to rent if renting makes the most sense for you right now while you save up. Don’t let this be an emotional decision. The best advice I got several times was to not let it be an emotional decision. Let go of any ideas about how things are supposedly meant to go. At the end of the day, it’s a business transaction, and you’re looking for the best deal for you. |

Niyamas | |

Saucha purity Cleanliness, or keeping our bodies and our surroundings clean and neat. | Less clutter means less stuff to move. Cleaning your home regularly and decluttering your belongings will literally lighten the load. Purify your thoughts. During your search, there will always be constraints (your budget, the interest rate, etc.) but nourish your mindset by focusing on the opportunities. Instead of focusing on the limits, focus on the levers you can pull. Take care of yourself physically and mentally during the home-buying process. This means eating healthy, getting enough sleep, and exercising. Keep your finances organized, and track your spending. Say a prayer of gratitude when money comes in, and declare that you circulate your dollars out in the name of peace. (Or in the name of whatever suits you.) |

Santosha contentment Contentment, or the ability to be comfortable with what we have and what we do not have. | Eyes on your own paper. Find satisfaction in your journey and let others have their happiness too. No need to compare your path to anyone else’s. Enjoy the home you find, even if it doesn’t have the features you initially wanted. Be grateful for the opportunity to own a home, and for the people who helped you along the way. Don’t expect everything to go perfectly, and be prepared to deal with some unexpected challenges. Be content with getting frustrated. To take it a layer deeper… you will get frustrated about something at some point. Be content with being frustrated. Accept that mistakes could be made or surprises could come up. It’s all ok, really. |

Tapas determination The removal of impurities in our physical and mental systems through the maintenance of such correct habits as sleep, exercise, nutrition, work, and relaxation. | Be persistent, and don’t give up on your dream of homeownership. Consistently show up even when you don’t feel like it. Allow the inner fire of determination to carry you through moments of fatigue ir disinterest. Remind yourself why you started. Be committed to the home-buying process. This means being prepared to do the work, such as researching homes, getting pre-approved for a mortgage, and hiring inspectors. Be disciplined in your home-buying process. This means setting realistic goals, sticking to a budget, and following through on your commitments. |

Svadhyaya self-study Study and the necessity to review and evaluate our progress. | Notice your thoughts, feelings, and behaviors at every step. Meditation and journaling are great tools for practicing svadhyaya. Slow down and observe yourself and any patterns for instance in your energy levels. It’s a big deal for your personal finances and for your nervous system to go from being a tenant to the owner. Learn as much as you can about the home-buying process. This includes reading books, articles, and blogs about home buying, and talking to people who have recently bought homes. |

Ishvara Pranidhana surrender, contemplation of a higher being Reverence to higher intelligence or the acceptance of our limitations. | Take the leap of faith. Trust that the universe will provide you with the perfect home at the perfect time. Remain conscious of your ego’s limitations and allow yourself to be guided by something bigger than you. Be willing to course-correct as you learn new things or gain new perspectives. Let go of any expectations, and being open to what life has to offer. Be grateful for the journey, even if it’s not always easy. |

Finally, I’d like to thank those who supported me through this process. It wouldn’t have happened without my friends and family, and my professional team, including my agent and lender. Gratitude can help us appreciate the teamwork that often goes into achieving our goals.

In the end, my experience goes to show that the lessons of yoga extend far beyond the mat. They can guide us through major life decisions, helping us navigate challenges with clarity, purpose, and a sense of fulfillment. Just as yoga taught me to find balance within myself, it also guided me in finding a place I can call home.